Dilution?

It may not be what you think

Anti-dilution protection. Everyone has heard that phrase. Most people think they know what it means. Many first-time entrepreneurs donŐt. That can lead to huge mistakes.

One of the problems is that ŇdilutionÓ has several meanings when it comes to doing a deal.

Percentage-Based Dilution

If you own 60% of the equity of your company before an investment and 30% afterward, thatŐs dilution.

If an investor owns 40% of your company before a round of investment and 20% afterward, thatŐs dilution.

BUT thatŐs NOT the kind of dilution that anti-dilution protection applies to.

Share Price Dilution

Confused?

Well, letŐs talk about the kind of dilution that investors do seek protection against.

If an investor buys shares of stock in your business at $1.00 per share and the next round of investment is at $0.50 per share, now thatŐs dilution.

Getting Back to Basics

LetŐs go back to some of the first things we talked about in this series of articles.

á Deals are negotiated with percentages, but are structured with shares.

á The value of a company is only known at the instant of a transaction when cash is being exchanged for equity.

á The value of a company is determined by multiplying the total number of common shares by the most recent share price.

á Pre-Financing Value + Investment = Post-Financing Value.

á Pre-Financing Value = Post-Financing Value – Investment.

á Price per share = Amount of investment divided by the number of shares purchased.

ThatŐs all pretty dry and boring gobblygook, unless itŐs your company and youŐre doing the deal.

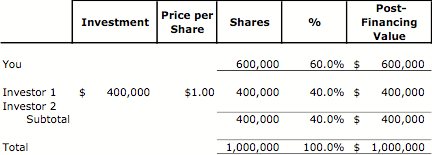

The First Round

LetŐs translate some of this into an example.

á I offer to invest $400,000 in your company in exchange for 40% of it.

á Since you own all 600,000 shares of your company, I am offering to buy 400,000 new shares in order to acquire 40%.

á My investment of $400,000 divided by 400,000 shares that IŐm buying yields a per share price of $1.00.

á Since you own 600,000 shares, that means the value of the stake in your company is $600,000, which is the pre-financing value.

á Adding my $400,000 to that yields a post-financing value of $1,000,000.

á That is confirmed by taking the total number of outstanding shares, 1,000,000 (your 600,000 and my 400,000) and multiplying that by the share price of $1.00.

á That also says that the post-financing value of your company is $1,000,000.

Everything is in balance. The world is good.

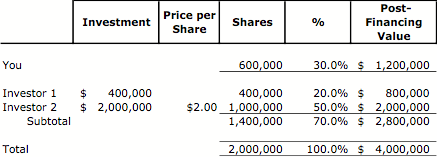

The Good Second Round: Share Price Increase

As time progresses, you and your company forge ahead. ItŐs time to raise some more money. Fortunately for you, you are in a business that venture capital investors are interested in. Several of them are looking at you, and after a while you negotiate a deal with one of them.

á The new investor offers to invest $2,000,000 for 50% of your company.

á If 50% of the company is worth $2,000,000, then the total company must be worth $4,000,000.

á Since there are 1,000,000 shares outstanding today and they will represent 50% of the company after the financing, then the new investor is buying 1,000,000 shares.

á The $2,000,000 investment divided by 1,000,000 shares yields a share price of $2.00.

á Since I paid $1.00 per share, IŐm happy. In fact, the 400,000 shares that I paid $400,000 for are now worth $800,000 (400,000 shares X $2.00 per share).

á The value of my investment has appreciated (grown in value).

á Even though the percent of the company I own has decreased (been diluted) from 40% to 20%, IŐm happy.

á By the same reasoning, your equity stake is now worth $1.2 million, and youŐve got $2,000,000 of investorŐs money to pursue your dream!

Everything is in balance. The world is good.

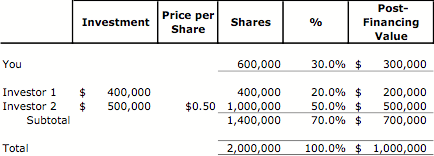

The Not-So-Good Second Round: Share Price Decrease

Alternatively, as time progresses, you and your company move forward. ItŐs time to raise some more money. Unfortunately for you, you are in a business that venture capital investors shun. Only one expresses lukewarm interest. Finally, you extract a deal.

á The new investor offers to invest $500,000 for 50% of your company.

á If 50% of the company is worth $500,000, then the total company must be worth $1,000,000.

á Since there are 1,000,000 shares outstanding today and they will represent 50% of the company after the financing, then the new investor is buying 1,000,000 shares.

á The $500,000 investment divided by 1,000,000 shares yields a share price of $0.50.

á Since I paid $1.00 per share, IŐm not happy. In fact, the 400,000 shares that I paid $400,000 for are now worth $200,000 (400,000 shares X $0.50 per share).

á The value of my investment has been diluted.

á In addition, the percent of the company I own has decreased (been diluted) from 40% to 20%.

á By the same reasoning, your equity stake is now only worth $300,000, and youŐve only got $500,000 of investorŐs money to keep your business alive.

Everything is in balance. The world is not so good. I want some protection against this form of dilution.

Recap

Dilution has several meanings in deal making. It is critical to understand the context. An investor is most concerned about the value of his investment. If a proposed transaction will reduce the value of the investorŐs investment (a lower price per share than he paid), he will seek anti-dilution protection.

Next week weŐll look at the types of anti-dilution protection.

Frank Demmler

is Associate Teaching Professor of Entrepreneurship at the Donald H. Jones

Center for Entrepreneurship at the Tepper School of Business at Carnegie Mellon

University. Previously he was president & CEO of the Future Fund, general partner

of the Pittsburgh Seed Fund, co-founder & investment advisor to the Western

Pennsylvania Adventure Capital Fund, as well as vice president, venture

development, for The Enterprise Corporation of Pittsburgh. An archive of this

series of articles can be found at my

website.