RAISING MONEY FOR NEW AND EMERGING COMPANIES

The purpose of this article is to explain what money resources are realistically available and when they are available during the evolution of a firm. We hope they help you in planning and structuring a business and increase the likelihood of your success.

To understand how Raising Money relates to the evolution of a new business, six key factors are important to understand.

1. This article focuses on embryonic businesses or ventures, prior to the time they have established an economically viable product with attractive markets, an attack plan that can be replicated, and a management team that can carry out the attack plan.

2. Ventures typically pass through developmental phases before they become commercially viable and successful firms.

3. The long time it typically takes for a venture to evolve affects the availability of funds.

4. As ventures evolve, the cash resources needed increase significantly with each phase.

5. Uncertainty must be resolved at each phase, since greater funds are needed for each step. An investor is making a subjective decision based upon perception of risk and reward.

6. The availability of different sources of capital, primarily debt or equity, depends on the developmental phase of the enterprise and its probability of successful commercialization.

Background: Life Cycle of a Business

All industries, businesses, and products pass through the four stages of a life cycle: Embryonic, Growth, Maturity, and Decline. What changes from business-to-business is the magnitude of the sales and the time for each. The dot.com boom and bust was short. Table salt is at the other extreme.

The focus of this article is the embryonic stage of the business life cycle and the sources of money that are available to firms in this stage of growth.

Purpose of the Embryonic Stage

The purpose of this stage is to evolve a business to a point where it has three key elements that will spell success: (1) An economically viable product or service with attractive markets; (2) an established plan of attack that can be replicated; and (3) a seasoned management team that has demonstrated that it can carry out the attack plan.

Phases within the Embryonic Stage

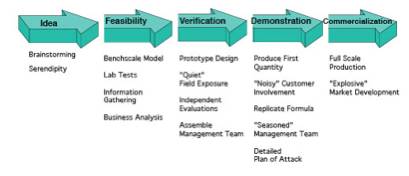

The embryonic stage can be broken down into five

identifiable, developmental phases: Idea, feasibility, verification, demonstration, and commercialization.

The idea phase is the creative step where the business concept is established.

The business idea can come from brainstorming, for example, speculating on how the application of a technology can better fill customers’ needs. Some successful businesses are the result of serendipity or the accidental discovery of a desirable product or service.

The idea is then researched and tested on a very limited scale in the feasibility phase. The primary question to be answered in this phase is: Does it work? A breadboard or laboratory model is generally constructed, and it may be tested with one customer under controlled conditions. A service would be structured and tested on a pilot basis with one customer. Market research using secondary sources and initial evaluations of the business economics are performed to assure the attractiveness of continued investment of time and money.

In the verification phase, the prototype service or pilot models are “quietly” field-tested. The primary question to be answered at this phase is: “Now that we know that it works, does anyone in the marketplace care?” This is the first commercial exposure to customers, but the exposure is purposely limited to allow time to improve the performance of the product or service. A key objective is to gain an in-depth understanding of the customer’s needs and how the product or service may be modified to better meet their needs. During this phase, the venture begins to evolve into a business, and key people are added to build the management team.

In the demonstration phase, the firm begins to scale up its operations to prove that it has a business formula that can be replicated for success. The product is refined for efficient, low cost production, and pre-production lot sizes are produced to show that consistent, acceptable units can be produced. An established selling approach is applied to a broader set of customers, such as those in a wider geographical area. The key management team demonstrates that it has the ability to implement a plan that can address a wider, possibly national market.

In the commercialization phase, major investments are made to achieve efficient, low-cost, full-scale production and for full-scale market development. For some firms, the investment in manufacturing plant and equipment can be many millions of dollars. The investment to introduce the product or service to a wide set of potential customers, such as spending for advertising or to build a national sales force, can often be more than spending needed for manufacturing facilities. This is especially true for service businesses or for computer software firms.

Time to Pass Through the Embryonic Stage

Many first-time underestimate the time it takes to build a business from the idea phase to the point where success or failure in the commercialization phase is clear. A study of 120 ventures showed an average time of 8 years to reach positive cash flow and evolve from the idea phase to the commercialization phase. [While I vaguely remember that there was such a study, I have no recollection of its source.] Others estimate the average time to profitability from 6-14 years.

Of course, there are exceptions to this average, and the exceptions are often the most publicized. Buying a franchise can have great appeal because it greatly reduces the time to commercialization by eliminating the idea and feasibility phases and shortening verification and demonstration phases. Someone else has already done the pioneering work.

The time needed by an individual firm to pass through the embryonic phase is an important factor that influences the amount and kind of money that a firm can seek.

Cash Needs Increase for Each Phase

The cash needs of a venture increase with each phase. The stakes go up to play in the next phase, and the costs of failure or exiting from a phase also increase.

One rule of thumb is that the cash needs for each phase increase by a factor of 5 to 10. By far, the most expensive step in the process is the commercialization phase.

For example:

- $1 is needed to establish an idea;

- $10 is needed to prove that it is feasible;

- $100 is needed to verify that it works in the field and that it really fulfills customers’ needs;

- $1,000 is needed to demonstrate that the product can be produced efficiently, that a marketing and selling formula is successful, and that the management team is effective;

- $10,000 is needed to produce the product in full-scale volumes and to develop a national marketing and sales campaign and organization.

Each Phase Should Reduce Uncertainty

Each developmental phase should reduce uncertainty or risk; each phase should increase the probability of success of the venture.

All decisions to provide funds to a venture are tied to somewhat subjective risk and reward trade-offs. The higher the perceived uncertainty and risk, the fewer the sources of capital which will be available, and the higher the return demanded by investors who do participate. The lower the perceived uncertainty of successful commercialization becomes, the more accessible financing will be. Furthermore, investors are likely to demand less of a share in the company because the perceived market value of the firm will be greater. The process of moving a venture through the phases must reduce uncertainty and improve the probability of success.

The largest financial decision is the decision to invest for commercialization, and the phases before this decision point should have reduced the perceived uncertainty and risk to a relatively low level.

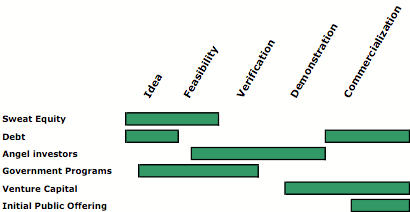

Funding Sources and the Relation to the Phases

The major sources of funds for firms in the embryonic stage

are:

Debt is generally not a major source of funds for ventures prior to the commercialization phase. An entrepreneur may obtain loans using personal savings or assets as collateral; other than this, debt is not a key source of funds for the feasibility, verification, or demonstration phases.

Lenders want low uncertainty of repayment and require collateral. Ventures do not develop assets such as accounts receivable, inventory, and manufacturing equipment, until they reach the demonstration or commercialization phases. Most government loan programs or loan guarantees are tied to the assets of the firm, mostly to bricks and mortar, and they still require the personal guarantee of key management.

Capital from individuals is often the key source of capital for most firms prior to the commercialization phase. This is particularly true for the cash needed for the feasibility and verification phases and for start-up firms that are not technology based and, therefore, cannot access federal, state, or local technology programs.

These funds are most often in the form of equity. Sweat equity is supplied from the entrepreneur’s own cash from savings and monthly cash that is provided because the entrepreneur and others often take sub-standard wages during a venture’s earliest phases. Equity can be raised by the entrepreneur’s personal efforts to sell stock to a personal network of potential investors.

Suppliers or customers can be an important source of funds for a developing business. Vendors may provide extended terms, or even provide products on consignment. Customers may provide down payments or cash advances against future orders.

Government programs may be available for technology research and development during feasibility, verification, and demonstration phases.

Venture capital is a source of equity capital for start-up firms. However, while some venture capital firms specialize in very early stage funding, this is the exception rather than the rule.

Most often, venture capital is not available until the firm has reached the demonstration phase, and possibly not until the firm is ready for commercialization. Many venture capital firms want to invest where the time horizon is relatively short, since they must liquidate their investments and provide cash return to their investors within a finite period of time. Less than 2% of the proposals reviewed by venture capital firms receive funding.

In certain cases, an alternative to venture capital is a private placement, in which the funds are raised by an investment banker for a fee.

Finally, if equity has been raised, a liquidity event must be provided to the investors. An initial public offering may be a desirable exit and an option for raising capital for a firm undergoing rapid expansion after the initial commercialization phase. A firm may need added equity to finance the rapid growth stage, or possibly the image of being a public company will add credibility to the firm with its potential customers.

Alternatively, a firm could be acquired in this phase. The acquirer may provide access to needed financial resources, as well as, provide marketing skills or production “know-how” to help in expansion.

Summary

- Ventures pass through five phases: Idea, Feasibility, Verification, Demonstration, and Commercialization.

- The time to pass through these phases is longer than most believe -- typically many years.

- Cash resources needed increase at each phase. The investment for commercialization overwhelms all previous investments.

- Many ventures are weeded out as they progress. Uncertainty must be resolved in each phase.

- The sources of cash to sustain an embryonic business depend on the phase of development and the perceived risk and uncertainty of successful commercialization.

Frank

Demmler is Associate Teaching Professor of Entrepreneurship at the Donald

H. Jones Center for Entrepreneurship at the Tepper School of Business at

Carnegie Mellon University. Previously he was president & CEO of the Future

Fund, general partner of the Pittsburgh Seed Fund, co-founder & investment

advisor to the Western Pennsylvania Adventure Capital Fund, as well as vice

president, venture development, for The Enterprise Corporation of Pittsburgh.