The Arithmetic Of Deals (A)

LetŐs start with a few basics about how corporations work from a structure perspective, and the mechanics of investments. [Note: the same concepts apply to LLCs, but the vocabulary is different.]

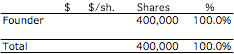

When you form your company, you will issue the initial shares of stock to the founding team. For the sake of simplicity, letŐs say that you are the sole founder and you issue 400,000 shares of common stock to yourself. [Note: the number of initial shares is essentially arbitrary, but it establishes a baseline from which lots of future actions will be calculated, as you will see later in this article.]

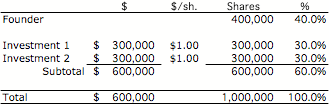

Upon launch, the capitalization table would look like this:

There are no values provided for the dollar entries, because there are none.

The division of the founder pie is established based upon the overall contributions and value (past, current and future) of the founding team. While the cash contributed and wages foregone will enter into this process, many other elements need to be considered. The net is that the founder pie does not have a specific value that can be stated in dollars. As we learned in last weekŐs column, the value can be whatever the founder(s) wants to say it is.

In this case, since youŐre the only member of the founding team, you own 100% of the company.

With this as a starting point, it is important for you to understand that investors will buy new shares from the company, not from the founder. Once the corporation is established, it is a separate legal entity. Once you have sold shares to an outsider, it is no longer Ňyour company.Ó It is the shareholderŐs company.

LetŐs take a look at how this plays out in an investment.

Scenario 1: Invest $600,000 for 60% of the company

First, we need to establish a definition:

Pre-financing

Value + Investment = Post-financing Value

Therefore, in the given example, in order to determine the pre- and post- financing values, some simple algebra will yield the following information:

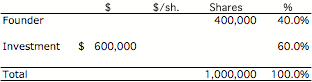

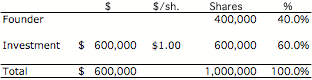

If a person invests $600,000 for 60% of the company, then the founderŐs equity would be 40%. Since 400,000 shares represent 40% of the company, we can use division to determine that the company has a total of 1,000,000 shares.

With that information we can fill in the blanks, determining that the investor

will buy 600,000 shares (1,000,000 – 400,000) for $1.00 per share

($600,000 invested divided by 600,000 shares purchased).

On a post-financing basis, the company would be worth $1,000,000 (1,000,000 shares outstanding multiplied by the transaction share price of $1.00).

The pre-financing value (the founderŐs stake) would then be calculated as follows:

Post-financing

Value - Investment = Pre-financing Value

$1,000,000 - $600,000 = $400,000

So far, so good.

Scenario 2: Same investment, but in two rounds of $300,000

LetŐs take a little quiz. In the previous scenario, an investor offered to buy 60% of a company for $600,000. How much would he buy for $300,000?

Since $300,000 is one-half of $600,000, you are likely to have answered 30%, one-half of 60%, and youŐd be wrong. The answer is almost 43%!

Deals are

negotiated with percentages, but they are structured with shares.

This appears to be a very simple concept, and it is, but it can be very complex in its application. The results are often counterintuitive. ThatŐs why an entrepreneur must recognize that and be very facile at performing the necessary arithmetic.

It is not unusual for an investor to do milestone investing, breaking an investment into more than one piece. This way, it is possible to limit the amount of the investment exposed at one time by tying subsequent portions of the investment to specific accomplishments.

In this scenario, we have broken the investment in half so that there are two rounds of $300,000 each. At the end of the two rounds, a total of $600,000 will have been invested for 60% of the equity of the company.

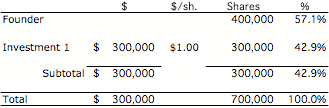

LetŐs look at the companyŐs capitalization table after the first $300,000 investment has been made.

Contrary to the intuition that might tell you that half of the investment amount should buy half of the equity position of the full investment, the arithmetic works out differently. $300,000 at $1 per share purchased 300,000 shares that represent 42.9% of the equity of the company, not 30%.

How can this be?

When an investor purchases equity from a company, he is purchasing shares and, therefore, the share base of the company increases. In our example, before financing, the founder owned 400,000 shares, which represented 100% of the outstanding equity. On completion of a round of $300,000, the total outstanding shares of the company increased from 400,000 shares to 700,000 shares, thereby yielding an equity position for the investor of 42.9% of the equity at that time.

Then, if the funding is completed as scheduled, an additional $300,000 buys the

investor an additional 300,000 shares that are also added to the share base of

the company. At the completion of

this financing, 1 million shares of the company are outstanding, of which the

investor owns 60% or 600,000 shares, just like in the first scenario.

Advice to the entrepreneur

Learning how to do the Arithmetic of Deals is critical for all entrepreneurs.

á Remember: Investors are buying new shares from the company.

á Remember: When someone in addition to you owns shares in your company, it is no long Ňyour company.Ó

á Remember: Deals are negotiated with percentages, but they are structured with shares.

á Open up your spreadsheet and try a few different scenarios for your company.

Frank Demmler (fd0n@andrew.cmu.edu) is Adjunct Teaching Professor of Entrepreneurship at the Donald H. Jones Center for Entrepreneurship at Carnegie Mellon University. (http://web.gsia.cmu.edu/display_faculty.aspx?id=168)